Put Calendar Spread - A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later. If a trader is bullish, they would buy a calendar call spread. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. There are two types of long calendar spreads:

Bearish Put Calendar Spread Option Strategy Guide

A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle. There are two types of long calendar spreads: A calendar spread is an options or futures strategy where an investor.

Bearish Put Calendar Spread Option Strategy Guide

When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. A diagonal spread allows option traders to collect.

Put Calendar Spread

A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. There are two types of long calendar spreads: A calendar spread.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle. A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the.

Long Put Calendar Spread (Put Horizontal) Options Strategy

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. This type of strategy is also known as.

Put Calendar Spread Option Alpha

A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A calendar spread allows option traders to.

Long Calendar Spread with Puts Strategy With Example

A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. If a trader is bullish, they would buy a calendar call spread. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. When running a calendar.

Bearish Put Calendar Spread Option Strategy Guide

Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations..

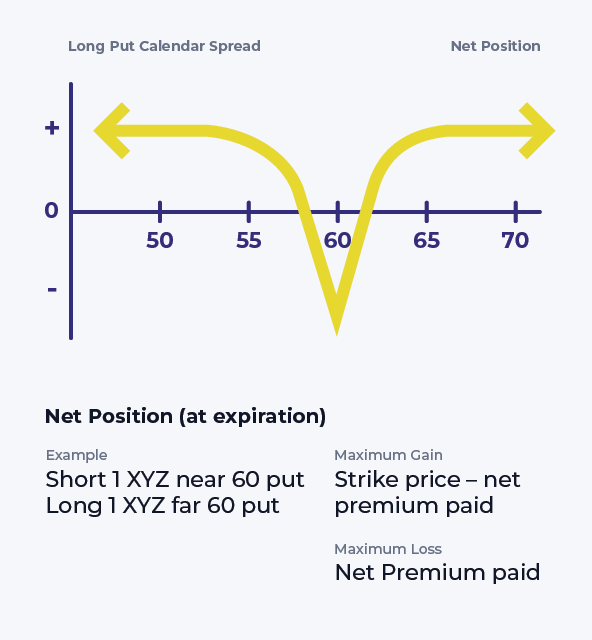

A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. There are two types of long calendar spreads: A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. If a trader is bullish, they would buy a calendar call spread. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle. A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay.

Whether A Trader Uses Calls Or Puts Depends On The Sentiment Of The Underlying Investment Vehicle.

If a trader is bullish, they would buy a calendar call spread. There are two types of long calendar spreads: A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations.

A Calendar Spread Is An Options Or Futures Strategy Where An Investor Simultaneously Enters Long And Short Positions On The Same Underlying Asset But With Different Delivery Dates.

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later.

This Type Of Strategy Is Also Known As A Time Or Horizontal Spread Due To The Differing Maturity Dates.

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)